With the development of teleworking, particularly after the Covid-19 pandemic, the rules governing the management of teleworking have undergone a number of changes. Understanding these rules is essential to ensure legal compliance, both in terms of social security and taxation. This article aims to clarify the rules that apply depending on your employees’ country of residence.

Teleworking and social security.

Germany, Austria, France, Italy, Liechtenstein and other signatories to the multilateral agreement :

On 1 July 2023, a new multilateral agreement came into force for several countries in the European Union (EU) and the European Free Trade Association (EFTA), including our neighbours Germany, Austria, France and Italy. This agreement allows cross-border commuters to telework up to 49.9% of their working time from their country of residence, while remaining affiliated to Swiss social insurance schemes. However, some administrative formalities are required.

Key points of the agreement:

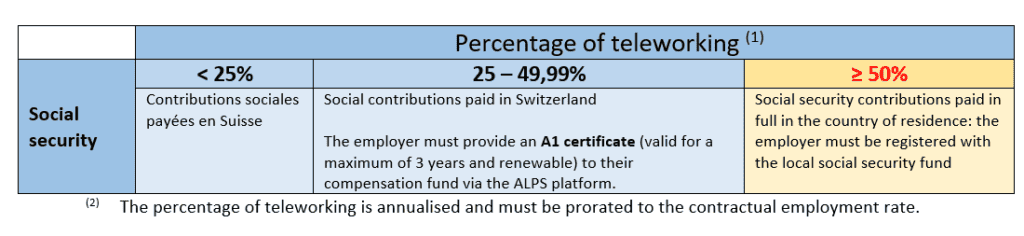

As an employer in Switzerland, it is your responsibility to monitor the percentage of your employees who telework and, if necessary, to request an A1 certificate to prove that they are covered by the Swiss social security system.

Below is a summary table:

Teleworking taxation

Teleworking also has a direct impact on the taxation of cross-border commuters. Days worked abroad must be taxed in the country of residence if the rate of teleworking exceeds a certain threshold, which varies from country to country.

France:

Since 1 January 2023, frontier workers residing in France have been able to telework up to 40% of their annual working time without this affecting their tax regime. The aim of this permanent agreement is to avoid the tax complications associated with the increasing use of teleworking. For these employees, taxation remains in Switzerland as long as teleworking does not exceed the 40% threshold, i.e. 2 days for a 100% employee. This rule also applies to temporary assignments carried out in France or another country, provided they do not exceed 10 days per year.

It is also important to remember that the Attestation de Résidence Fiscale (ARF) is still compulsory for French cross-border commuters working in the Swiss cantons of Bern (BE), Basel-Landschaft (BL), Basel-City (BS), Jura (JU), Neuchâtel (NE), Solothurn (SO), Vaud (VD) and Valais (VS).

Italy:

The situation is different for Italian cross-border commuters. From 1 January 2024, these employees may telework up to 25% of their working time without any impact on their tax regime.

As long as the percentage of teleworking remains below these thresholds, the employee will only be taxed in Switzerland.

Key points to remember

In conclusion

Managing teleworking for cross-border employees requires in-depth knowledge of international agreements and constant vigilance to ensure compliance with tax and social security rules. As a Swiss employer, good management of these aspects enables you to protect your business while offering your employees the flexibility they need when teleworking.

By subscribing to our AdminPack services, you can keep abreast of current legislation and updates to ensure that your human resources management complies with the regulations.