The AVS 21 reform, which among other things introduces early retirement options, requires employers to play an active role in their employees’ transition to retirement. This article provides an overview of the practical steps you can take to support your employees in this process, while ensuring that you meet your legal obligations, particularly with regard to AVS contributions.

1. Informing your employees

It is essential that your employees understand the early retirement options offered by the AVS 21 reform. Organise information sessions to cover :

– The legal retirement age for men (65) and women (64 until 2024, then 65 from 2025).

– The possibility of taking early retirement from 1 to 24 months after the age of 63 for men and women (and 62 for women born between 1961 and 1969).

– The financial impact, in particular the reduction in AVS pension of 6.8%/year per year of early retirement.

Practical tip: Make retirement simulation calculation tools available to help employees better understand the consequences of their choices and anticipate pension reductions.

2. Supporting the early retirement application

The administrative steps involved in early retirement require special attention. Here are the key stages:

– Plan discussions in advance: Encourage your employees to raise the issue of early retirement at least 6 to 12 months before the desired date.

– Formalise the request: Employees must submit a written request to the AVS compensation fund at least three months before the desired early retirement date. It is important to support them in this process by providing the necessary documents and advice.

– Coordination with the pension fund: If your employees also wish to draw their second-pillar pension before the statutory retirement age, you must inform them of the specific rules of their pension fund and assist them with the formalities.

3. Managing AVS contributions after retirement

One aspect of early (partial) retirement that is often overlooked is the management of AHV contributions.

If the employee continues to work and earns income after taking early retirement, the employer must continue to pay AVS contributions.

However, the work must be part-time, with a reduction in the rate of employment of at least 20%.

– Early retirement with gainful employment: Even if the employee continues to work and receives income from gainful employment after taking early retirement, both he and the employer must continue to pay AVS contributions until the age of 65 for both men and women (64 for women born between 1961 and 1969).

– Early retirement without gainful employment: If the former employee is no longer working and does not receive any income, he or she may be considered to be without gainful employment. In this case, they must pay minimum AVS contributions during the period of early retirement. But this is not the employer’s responsibility. However, if the person’s spouse is working and paying sufficient contributions, no contributions are due.

Why this obligation?

Under Swiss law, AHV contributions must be paid up to the statutory retirement age, even if the employee has stopped working. If the employee is still in receipt of income (pensions, allowances or income from part-time work), the contributions are of course still due.

AVS pensions are directly influenced by the contributions paid throughout an employee’s career. Maintaining contributions, even after you stop working, ensures a higher pension amount, which is crucial to guaranteeing financial security in retirement.

Note: If an employee continues to work after retirement age, AVS/AHV contributions are only due on the part of the income exceeding an excess of CHF 16,800 per year. This rule reduces the burden while ensuring that contributions remain relevant.

Employer’s responsibility: You must ensure that AVS contributions are correctly deducted and paid, even after the employee has ceased their main activity, for as long as they receive income. This also includes the responsibility for managing the reintegration into the occupational pension scheme if the employee takes up a post-retirement activity and wishes to continue to contribute to the LPP (supplementary compulsory). The terms and conditions of your contract with your pension fund will apply (e.g. the period between a stoppage and a partial return to work). In addition, any conditions linked to your CCNT or trade are reserved.

4. Propose transitional solutions

– Part-time work: You can offer reduced-time work options for employees approaching retirement, enabling them to retain an income while gradually reducing their workload.

– Second-pillar contributions: If an employee chooses to continue working part-time, they can also continue to contribute to their pension fund, which could increase their future benefits.

– Offering a bridging pension: This measure, like a temporary allowance from the employer, is used to compensate for the loss of income due to early retirement, before reaching the statutory retirement age.

Conclusion

The AVS 21 reform marks a turning point in pension management in Switzerland. It is crucial for employers to look beyond mere legal obligations and see this period as an opportunity to strengthen relations with their employees, and to position themselves as a key player in this change of life. Anticipation and dialogue will be your best allies.

With the implementation of the AVS 21 reform, which standardises the retirement age at 65, and the recent rejection of the LPP reform proposal, it is essential for employers to understand the challenges facing women’s pension provision and adopt the appropriate strategy. These challenges include the loss of earnings due to careers often interrupted to devote themselves to the family, part-time work and salaries that are relatively lower than those of men. Ekspert takes a closer look.

AVS 21 reform: what changes?

– Uniform reference age: All insured persons will have a reference age of 65, with the option of withdrawing their capital between the ages of 63 and 70.

– Greater flexibility : Introduction of the possibility of partial retirement and flexibility in the choice of pension commencement.

– Transitional measures: For women born between 1961 and 1969, compensatory measures have been introduced to cushion the impact and phase in the increase in retirement age.

BVG reform rejected

This reform, which was intended to improve cover for part-time workers and low-paid workers, and to strengthen the financing of the 2nd pillar, was rejected in the vote on 22 September 2024 . In particular, it would have allowed contributions and benefits to be better adapted to the needs of women working part-time, for example by proposing a pro-rated coordination deduction rather than a fixed amount, which, according to the supporters of the yes vote, would have made a significant contribution to improving their pensions. But uncertainty about the real impact for each insured person and the difficulty of projecting ahead led to the rejection.

Specific challenges

1. Increased longevity : On average, women live longer than men.

2. Unequal pay and part-time work: These factors lead to lower contributions (lower retirement capital).

3. Career breaks: Professional breaks for maternity or caring for relatives have a negative impact on their pension provision.

Solutions and best practice for employers

1. Flexible pension plans :

o Adjusting the coordination deduction: Adjusting the coordination deduction in proportion to working time can help to introduce greater fairness by not excessively penalising their pension cover.

o Optional contribution options: Encourage employees to maximise their contributions during periods of full employment and offer them the possibility of making buy-backs for periods not covered or maintaining 100% contributions (e.g. unpaid leave for parenthood, sabbaticals). In the event of forgetfulness or lack of liquidity at the time of leave, unlike the 1st pillar, these contributions can also be paid retrospectively!

o Choice of Fund: Opt for a pension fund with a higher return and offering a choice of contribution plans.

2. Raising awareness and providing information :

o Organise regular information sessions on retirement provision to clarify the options available (such as using the tax advantages offered by Pillar 3a) and recent legislative changes.

o Provide personalised consultations to help employees understand how to optimise their pension provision based on their professional and personal career paths.

3. Early and partial retirement :

o Offer early or partial retirement options, in line with the provisions of the AVS 21 reform, which introduces more flexibility in the choice of retirement age.

4. Compensatory measures for the transition :

o For women born between 1961 and 1969, who are particularly affected by the gradual increase in the retirement age, offer solutions to mitigate the impact, such as pension supplements or flexible retirement options.

Individual pension strategies

For their part, women can adopt several strategies to optimise their retirement:

1. Early planning: Starting retirement planning as early as possible is crucial to maximising accumulations in all three pillars (or at least two). Ask your pension fund, via your employer, about unpaid leave before taking time off.

2. Maximise contributions :

Ask your employer about the different contribution plans available and the performance of the pension fund. Maintain payment of contributions in the event of unpaid leave (e.g. for a sabbatical year or extended parental leave).

3. Interruption management: Compensate for career interruptions by buying back contributions or making voluntary payments to minimise the impact on future benefits.

4. Financial education: Find out about and obtain personalised advice on financial planning that takes account of your specific situation.

Conclusion

Employers have an essential role to play in securing the financial future of their employees. By adopting proactive and inclusive strategies, they can not only ensure fairness and compliance but also improve well-being and job satisfaction. This, in turn, will contribute to greater productivity and a more harmonious working environment. Adequate preparation for retirement for women requires a personalized approach that takes into account both the demographic challenges and the individual needs of each employee. In order to avoid gaps in the pension fund (LPP), which can vary depending on the rate of activity, salary, age and the length of unpaid leave, anticipation is essential.

In this new article on our topic of withholding tax, we will clarify the different scales that exist and provide practical information to help employers deal with this important aspect of payroll management.

2. Specific cantonal rules for Italian and German cross-border commuters

Some cantons have specific rules on withholding tax for cross-border commuters, particularly those from Italy and Germany. These special rates take account of international tax agreements between Switzerland and these countries, aimed at avoiding double taxation while ensuring that cross-border workers contribute to local taxes.

Italian cross-border commuters : R, S, T, U, V scales

In the cantons of Valais, Ticino and Grisons, new Italian cross-border commuters, i.e. those who start working in Switzerland after 17 July 2023, will be taxed according to different rates. These rates are the result of the tax agreement signed between Switzerland and Italy, which precisely defines the concept of ‘cross-border commuter’ and the applicable tax regime. Those who began working in Switzerland before this date remain subject to the rates defined in point 1 above.

The rates applied to Italian cross-border commuters are as follows:

German border residents: Rates L, M, N, P, Q

Under the tax treaty signed between Switzerland and Germany, these workers are taxed at reduced rates if they meet the conditions of a ‘genuine cross-border commuter’. A German cross-border commuter is defined as a person working in Switzerland who returns to his or her place of residence in Germany on a daily basis.

The cantons using these rates are Basel (town and country), Aargau, Solothurn, Schaffhausen and Zurich.

The rates applicable to German cross-border commuters are as follows:

3. When and how to update an employee’s salary scale

In conclusion, effective management of withholding tax scales depends on a thorough knowledge of the rules in force and the particularities of each canton. It is essential that employers remain alert to changes in their employees’ circumstances and encourage them to report them promptly.

Thanks to the expertise and mastery of the Ekspert teams, we are able to notify you as soon as a change in situation affects the withholding tax scale of your employees. This will simplify your day-to-day management and save you precious time.

Taxation at source (withholding tax) is an unavoidable obligation for employers, particularly when it comes to foreign workers and cross-border commuters, for whom international agreements are in force.

Beware of the administrative follow-up if you change residence or status! This practical guide is designed to help you understand and apply withholding tax correctly for your employees, because mistakes can be costly!

How they are taxed depends on the canton in which they work.

Tax system by canton :

Procedure for the employer :

Practical example:

A cross-border commuter working in Geneva with a gross salary of CHF 8,000 is subject to withholding tax in accordance with the Geneva rates. However, if he moves to another canton such as Vaud, he will have to declare his income in France, and will no longer be taxed at source in Switzerland, from the month following his official change of address, according to the attestation of tax residence. (Anyone who does not send the attestation will still be taxed at source and will have to take steps to rectify the situation as soon as they submit it).

Moving from Switzerland to France and vice versa

Steps for the employer :

o If you manage multi-site employees, check the tax rules of the canton where you work and follow up the required documents

o Do not change anything until you have received the official documents, even if it means doing so retrospectively.

Conclusion

Adopt the right reflexes! Managing withholding tax in Switzerland demands rigour and attention, particularly when it comes to changes in status or residence. Employers not only have to calculate and deduct tax correctly, they also have to be responsive to changing circumstances.

Call on Ekspert, specialists in payroll management and Abacus partners, to ensure you are surrounded by experienced professionals and avoid any unpleasant surprises!

With the development of teleworking, particularly after the Covid-19 pandemic, the rules governing the management of teleworking have undergone a number of changes. Understanding these rules is essential to ensure legal compliance, both in terms of social security and taxation. This article aims to clarify the rules that apply depending on your employees’ country of residence.

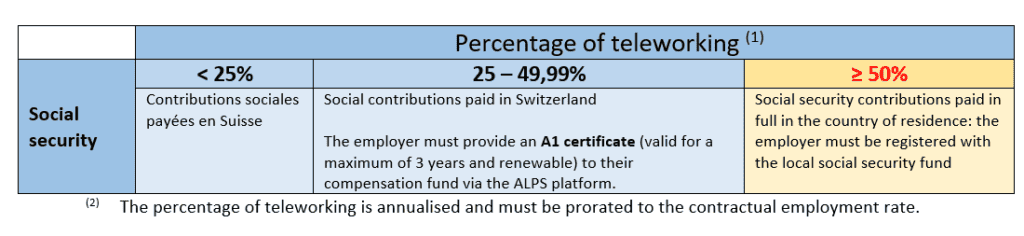

Teleworking and social security.

Germany, Austria, France, Italy, Liechtenstein and other signatories to the multilateral agreement :

On 1 July 2023, a new multilateral agreement came into force for several countries in the European Union (EU) and the European Free Trade Association (EFTA), including our neighbours Germany, Austria, France and Italy. This agreement allows cross-border commuters to telework up to 49.9% of their working time from their country of residence, while remaining affiliated to Swiss social insurance schemes. However, some administrative formalities are required.

Key points of the agreement:

As an employer in Switzerland, it is your responsibility to monitor the percentage of your employees who telework and, if necessary, to request an A1 certificate to prove that they are covered by the Swiss social security system.

Below is a summary table:

Teleworking taxation

Teleworking also has a direct impact on the taxation of cross-border commuters. Days worked abroad must be taxed in the country of residence if the rate of teleworking exceeds a certain threshold, which varies from country to country.

France:

Since 1 January 2023, frontier workers residing in France have been able to telework up to 40% of their annual working time without this affecting their tax regime. The aim of this permanent agreement is to avoid the tax complications associated with the increasing use of teleworking. For these employees, taxation remains in Switzerland as long as teleworking does not exceed the 40% threshold, i.e. 2 days for a 100% employee. This rule also applies to temporary assignments carried out in France or another country, provided they do not exceed 10 days per year.

It is also important to remember that the Attestation de Résidence Fiscale (ARF) is still compulsory for French cross-border commuters working in the Swiss cantons of Bern (BE), Basel-Landschaft (BL), Basel-City (BS), Jura (JU), Neuchâtel (NE), Solothurn (SO), Vaud (VD) and Valais (VS).

Italy:

The situation is different for Italian cross-border commuters. From 1 January 2024, these employees may telework up to 25% of their working time without any impact on their tax regime.

As long as the percentage of teleworking remains below these thresholds, the employee will only be taxed in Switzerland.

Key points to remember

In conclusion

Managing teleworking for cross-border employees requires in-depth knowledge of international agreements and constant vigilance to ensure compliance with tax and social security rules. As a Swiss employer, good management of these aspects enables you to protect your business while offering your employees the flexibility they need when teleworking.

By subscribing to our AdminPack services, you can keep abreast of current legislation and updates to ensure that your human resources management complies with the regulations.

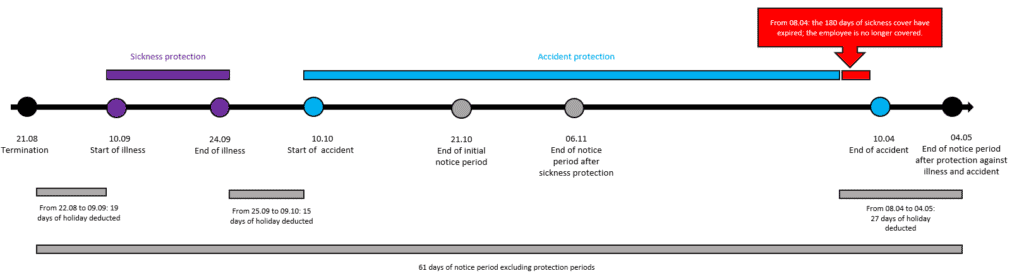

In our final article on the subject of incapacity for work, we take a look at the distinction between notice periods and protection periods, which can be a real challenge for employers to manage. Between the law and contractual specificities, the risk of making mistakes is high, which can have significant legal and financial consequences. Ekspert is here to help you navigate these complex waters and avoid common pitfalls.

Understanding notice periods

Leave periods vary according to a number of criteria, including the length of service of the employee and the nature of the contract (fixed-term or open-ended). Here are the key points to be aware of:

Distinguishing between protection periods

Protection periods are periods during which an employee is protected against dismissal, particularly in the event of illness, accident, pregnancy or military service. Here’s what you need to know:

Pitfalls to avoid

Case study:

Mr Dupont, an employee with 7 years’ seniority, receives a letter of dismissal on 21 August. The contractual notice period is 2 months net, with an end date of 21 October. However, several events disrupt this period.

Calculation of the actual notice period :

How can you be sure you’re doing the right thing?

Managing notice and protection periods is not only complex but also crucial to avoiding disputes.

It’s easy to get lost in the dates and confuse the end of the notice period with the end of the protection period or the end of the employment contract.

At ekspert, we manage this with precision and compliance.

Contact us today for more information about our AdminPack services!

Managing staff is a delicate task, requiring not only human resources skills but also a good understanding of the legal aspects. One of the thorniest issues for employers is how to distinguish between illness and accident when one of their employees suffers a health problem. Although this distinction is subtle, it has major implications for the way costs are met and the continuation of salary. Here’s what you need to know to avoid common pitfalls and manage these situations effectively.

What does the law define as an accident?

According to the Federal Law on the General Part of Social Insurance (LPGA), an accident is characterised by five specific and cumulative conditions:

Why is this distinction crucial?

The distinction between illness and accident is essential, as it determines which insurance will cover the costs and how absences will be managed. If the event is classified as an accident, accident insurance (LAA) will cover the costs, with no deductible or co-payment for the employee, and a wider range of benefits than basic health insurance. If the injury is considered an illness, basic health insurance will cover the costs, often at the employee’s expense.

Pitfalls to avoid and points to watch out for

Inguinal hernia

An inguinal hernia (relating to the groin) is generally an illness, unless it occurs after a sudden and unusual physical effort, such as lifting a very heavy object unexpectedly.

However, if carrying heavy loads is part of the employee’s daily routine, this same hernia will be considered an occupational illness (covered in the same way as an accident).

Tinnitus after a concert

If an employee develops tinnitus after a concert, this is not an accident, as the exposure to noise was prolonged and not sudden. However, if the tinnitus occurs after a sudden explosion at a festival, it could be considered an accident.

Insulation

Inadvertently spending hours in the sun at the risk of catching sunstroke leading to incapacity for work is considered to be an illness, due to the foreseeable and non-sudden nature of the event, caused by negligence on the part of the person concerned.

Conclusion

Distinguishing between illness and accident is not always easy, and can become a real headache for employers.

In fact, wrongly declaring an illness to your accident insurer could increase the costs of managing your contract (file management fees) and lead to an increase in your premiums.

At ekspert, we are used to this and are here to help you save time. By mastering the legal criteria and adopting rigorous documentation and monitoring practices, we can ensure that these situations are managed efficiently.

Contact us today for a personalised quote!

As we head into the summer months, it’s time to talk holidays! These precious moments of relaxation are meant for rest and relaxation, but they can go wrong.

What should you do if one of your employees falls ill or has an accident while on holiday? Does it make a difference if they’re abroad? What are the employer’s rights and obligations in such a situation?

To provide you with the best possible information, we have put together a guide to the most important points:

What are the rules on sickness/accidents during holidays?

The law is clear: holidays must allow employees to rest (in accordance with 329 ff of the Swiss Code of Obligations). If an employee falls ill (or is injured in an accident) to such an extent that they are unable to enjoy their holiday, they can reclaim these lost days of leave. This generally excludes incapacity of less than 3 days or incapacity not exceeding 30% of the planned rest period. It is therefore important to distinguish between incapacity to work and incapacity to take holidays.

Here are a few key points to bear in mind:

What should employers look out for?

To avoid disputes and ensure that leave is managed smoothly, here are a few recommendations for employers:

Why delegate management?

Understanding and correctly applying the rules concerning the recovery of lost holiday days in the event of illness (or accident) helps to maintain a fair and respectful working environment. Trust ekspert to manage these situations with rigour, precision and responsiveness, and concentrate on what really matters: the success of your company!

We can help you with all the administrative aspects of personnel management. We ensure that every situation is handled in accordance with the law, protecting both your interests and those of your employees.

For more information, contact us today to find out more about our dedicated personnel management services!

Welcome to our latest article on managing child benefit!

Specific rules to be aware of

International Conventions

In Switzerland, family allowances for children living abroad are only paid if Switzerland is obliged to do so under an international social security agreement. Such agreements exist in particular with the European Union (EU) and the European Free Trade Association (EFTA). For agricultural workers, agreements also exist with certain other countries, such as Türkiye.

Type of benefits that can be exported

Where an entitlement to benefits exists, only certain benefits are exported:

o Child allowance and training allowance: exported.

o Childbirth allowance and adoption allowance: not exported.

o Household allowance for agricultural workers: exported in certain cases.

Education abroad

Children leaving Switzerland for training purposes are presumed to remain resident in Switzerland for five years, thereby continuing to be entitled to family allowances. However, this presumption may be overturned if certain criteria are met, such as loss of compulsory health insurance (LAMal) or lack of regular contact with Switzerland.

Special cases

EU/EFTA nationals

Nationals of EU/EFTA countries who are gainfully employed in Switzerland are entitled to benefits for their children who are resident in the EU/EFTA. (Benefits are also payable to persons not in gainful employment domiciled in Switzerland, provided their children live in the EU/EFTA).

Children living in non-contracting countries

Family allowances are not generally paid for children living in countries with which Switzerland does not have an agreement, except in the case of certain Swiss employees working abroad or seconded by a Swiss company.

Brexit

Since 1 January 2021, the rules for the United Kingdom have changed. People in a situation of expatriation or residence with the UK before this date continue to receive family allowances, but new cross-border situations after 2021 no longer give entitlement to these allowances.

How ekspert can help

Managing family allowances for children living abroad involves in-depth knowledge of complex rules and tedious administrative procedures. At ekspert, we specialise in this area and offer comprehensive services to manage these aspects for you:

o Entitlement analysis: to determine your employees’ entitlement to family allowances in accordance with the relevant international conventions.

o File management: to set up and follow up files with the relevant institutions.

o Personalised advice: to optimise their entitlements and answer your specific questions.

o Administrative follow-up: to ensure that the benefits received are those due, taking into account any changes in legislation or circumstances.

Entrusting us with the management of your staff’s family allowances relieves you of the associated administrative burden, saves you a lot of time and ensures that your employees’ rights are fully respected.

By delegating this task to us, you strengthen your employer brand and offer your employees peace of mind and comfort!

Contact us today for more information!

Entrusting the administrative management of your staff to ekspert PLC, an Abacus partner specialising in these procedures, means choosing peace of mind and time saving.

Our experts will take care of all the complex formalities and subtleties of the law, so you don’t have to worry or wonder. Find out how Julie, our specialist, clarifies the most technical aspects of training allowances with a customer who has subscribed to our AdminPack service.

Julie (ekspert) : Hello Mr Martin, how can I help you today?

Paul Martin (HR Manager customer): Good morning. I’ve got some questions about training allowances for one of our employees, but frankly I don’t think it’s really useful. I don’t think he’s entitled to it, but I want to be sure.

Julie: I understand your concerns. What exactly do you want to know?

Paul: In my experience, benefits are only available if the child is at least 16. Our employee’s child is 15 and is about to start post-compulsory education. That’s not going to work, is it?

Julie: In reality, if the child has completed compulsory schooling and is at least 15 years old, he or she can receive training allowances from the start of his or her post-compulsory training. The age limit of 16 is not a blocking criterion.

Paul: Really? I thought it was rigid. And these allowances are only paid for a year, aren’t they?

Julie: Not at all. The benefits are paid until the end of the child’s training, but no later than the month in which he or she turns 25.

Paul: OK. But if the child starts training before the age of 16, that complicates things, doesn’t it?

Julie: In fact, if the child starts training before the age of 16, the employee can benefit from the allowances as soon as the child has reached the age of 15. There are no additional complications.

Paul: And if the child works while studying, that cancels out the benefits, doesn’t it?

Julie: No, as long as the child’s gross income does not exceed CHF 2,450 per month or CHF 29,400 per year, including the 13th salary, this does not cancel the benefits. Please note that daily allowances from certain insurance companies are also considered as income.

Paul: I’ve been told that retroactive allowances are impossible. So if the employee doesn’t apply in time, or if they provide us with the training certificate after the training has started, they lose their entitlement.

Julie: That’s not correct.Retroactive claims are possible. If the employee did not apply for benefits from the outset or takes several months, for example, to obtain a training certificate, he or she can do so within 5 years of becoming entitled and receive payments for the periods in the past when he or she was eligible.

Paul: In the end, it’s much more flexible than I thought.Thanks for clarifying!Julie: You’re welcome.Managing child benefit may seem complex, but it’s our speciality. We’re here to make your life easier. See you soon!

By entrusting the management of your child benefit to our specialist teams, you benefit not only from clear and reassuring expertise, but also from a partnership that frees up your resources to concentrate on developing your business.

Contact us today to find out how we can simplify and optimise the administrative management of your staff!